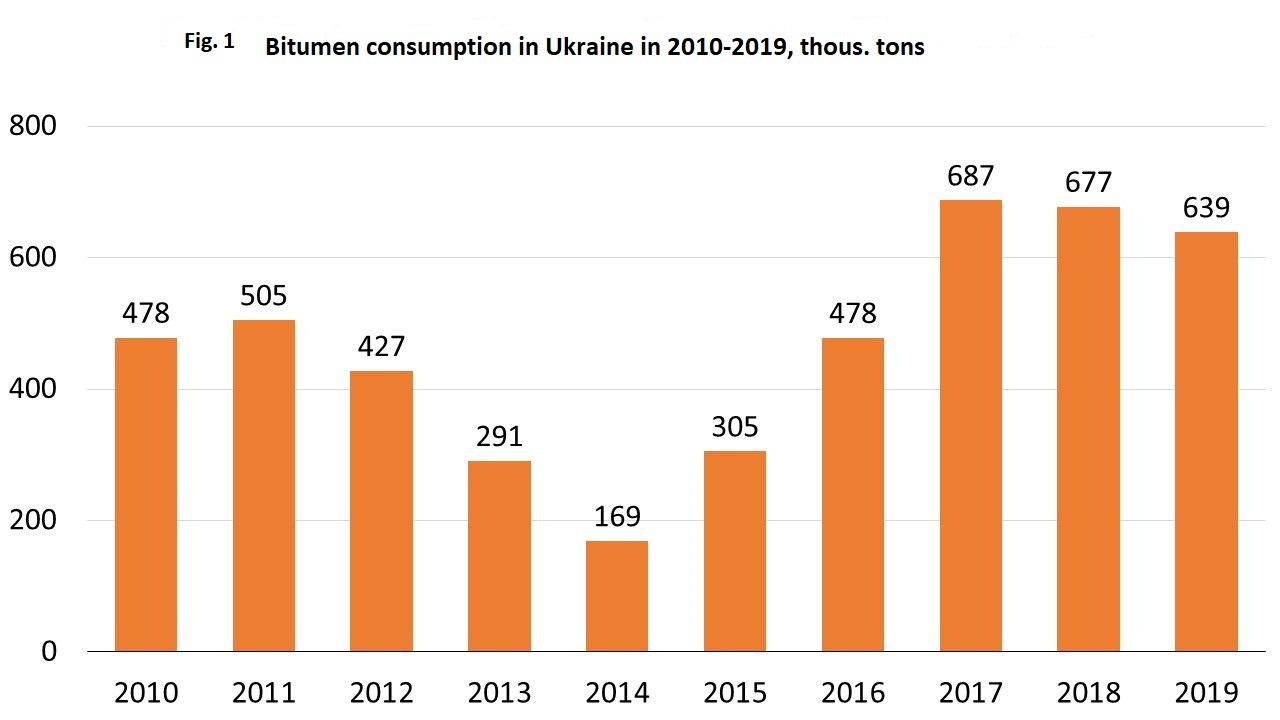

Road bitumen consumption is the best indicator of the situation in the road construction sector. In 2017-2019, there were registered record volumes of supplies for all the years of independence — an average of about 650 thousand tons per year. While the previous peak was in 2011, when the country was preparing for Euro 2012. But 2020 can see a new historical record — up to 900 thousand tons of bitumen. However, in the context of recent events, such scenario is becoming less possible.

The record year should have been 2019, when the volume of funding amounted to 55 billion UAH (compared to 32.6 billion UAH the year before). But the whole game was ruined by numerous elections and a power reset: at the height of the season, funding started to interrupt.

"Governors and officials of the Cabinet of Ministers started to get ready to leave, began to push funds through their channels, and left the roads for later, for the newcomers. For the second year in a row the market stopped in the middle of summer, when this money is needed the most, " said one of the traders, sharing his version of the reasons for the decline in bitumen consumption in 2019. As a result, the market managed to use 639 thousand tons of product, falling short of the previous two years level of about 35 thousand tons or 5%.

Data source: A-95 Consulting Group

Supply sources: the sea is just around the corner

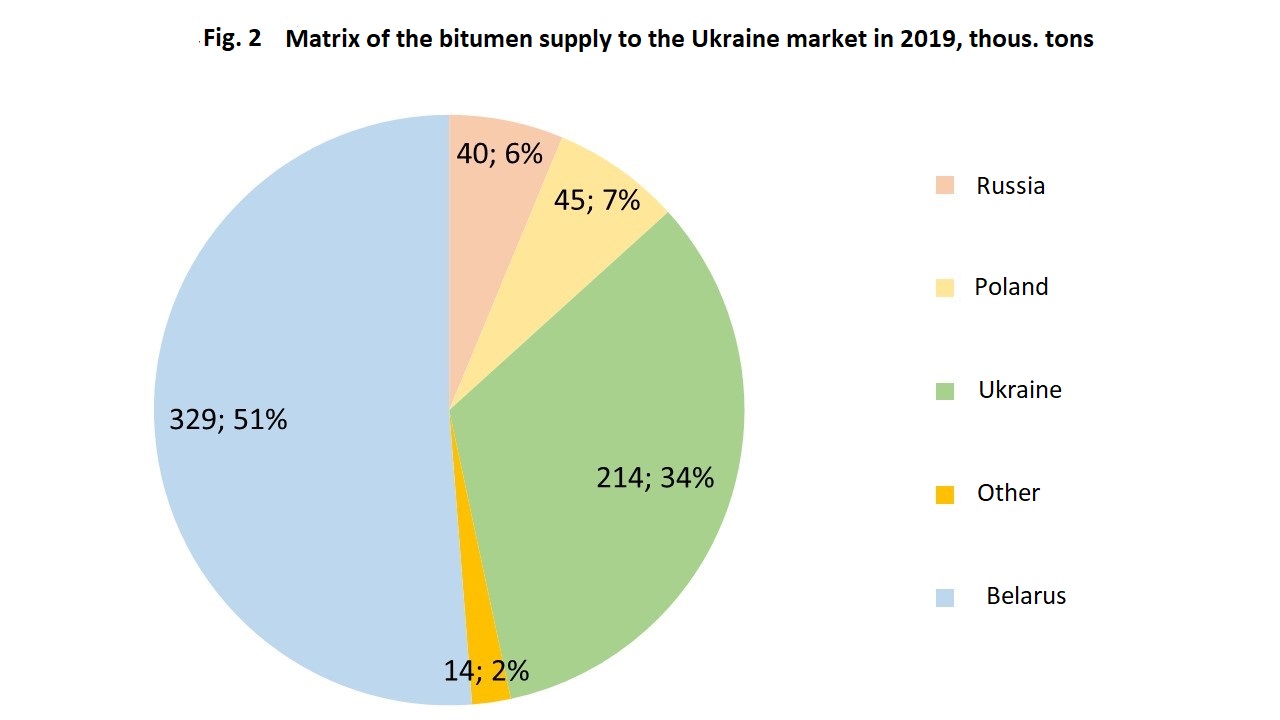

But the record came in another place. Ukrtatnafta, the Kremenchug refinery, stepped up the bitumen production by almost 60% (208 thousand tons) over the year and thus showed the best result for the last 9 years (191 thousand tons in 2010). Apparently, the Kremenchug manufacturers liked it: in 2020, they promise to produce 300 thousand tons of bitumen. This is not surprising, since bitumen is an alternative to the production of petroleum residue, being a totally unprofitable product in any refinery portfolio. Moreover, the price of this product will be much better than the petroleum residue, which we will discuss below.

Data source: A-95 Consulting Group

Belorussian refineries continued to hold the lead, losing volumes for the third year in a row. In 2017, they produced 455 thousand tons, in 2018 — 379 thousand tons, and last year — 329 thousand tons. Considering the lowered demand, the main role in this decline was played by the above-mentioned growth in domestic production volume.

There was also marked a change in the structure of Belorussian suppliers. It is clear that Mozyr is becoming the flagship exporter to Ukraine (72% of supplies), while the Naftan refinery, located in the north of Belarus, is regarded as a backup supplier: in 2019, its shipment volumes went down three times and amounted to 11% of Belorussian imports.

The third exporter was the Neftebitumny Zavod (Oil bitumen plant), which supplied 15 thousand tons to Ukraine. This specialized enterprise that uses raw materials received from Belorussian refineries, is a manufacturer of high-quality modified bitumen and emulsified bitumen. In 2020, the plant plans to step up supplies to Ukraine.

The market had high hopes for Russia in 2019. The growing volumes and prices, made the Russian product a "passable", despite a 10% duty. However, in May, the Russian government imposed an embargo on the supply of a number of petroleum products to Ukraine, including bitumen for unknown reasons, although this item cannot be called mass (in 2018, 122 thousand tons were imported, while imports of diesel fuel, for example, amounted to 2.5 million tons).

The growing demand for bitumen is pushing the market players towards exploring new supply channels. The most well-known is the Polish one: the Orlen Asphalt stepped up shipments by 25%, although in absolute terms, these 40 thousand tons are certainly a drop in the ocean. The imports increase in this direction is hampered by limited resources of the Polish manufacturer, as well as by the higher cost of the modified bitumen it manufactures.

The test supplies from Hungary, Azerbaijan and Lithuania can be highlighted as exotic destinations.

But the main topic in industry is different - the sea. This method of transportation, which at the moment looks fantastic, has been extensively used for a long time around the globe. A new mega-airport in Istanbul was built thanks to millions of tons of "sea" bitumen. International traders say that receiving from the sea does not require special infrastructure, there are mobile technical solutions for loading into road transport directly from the ship. But, similar to all marine resources, this resource is more expensive and needs sustainable consumption. Nevertheless, the idea of the sea has already firmly rooted in the minds of both traders and major "road builders".

The time has come to look for new routes. With the 2020 demand forecast of 900 thousand tons of bitumen, about 750 thousand tons will be provided by the Belorussian duo (considering the maximum volume of supplies of 455 thousand tons imported in 2018), and about 50 thousand tons will be provided by other sources. As a result, the question remains about 100 thousand tons or more than 10% of the required needs.

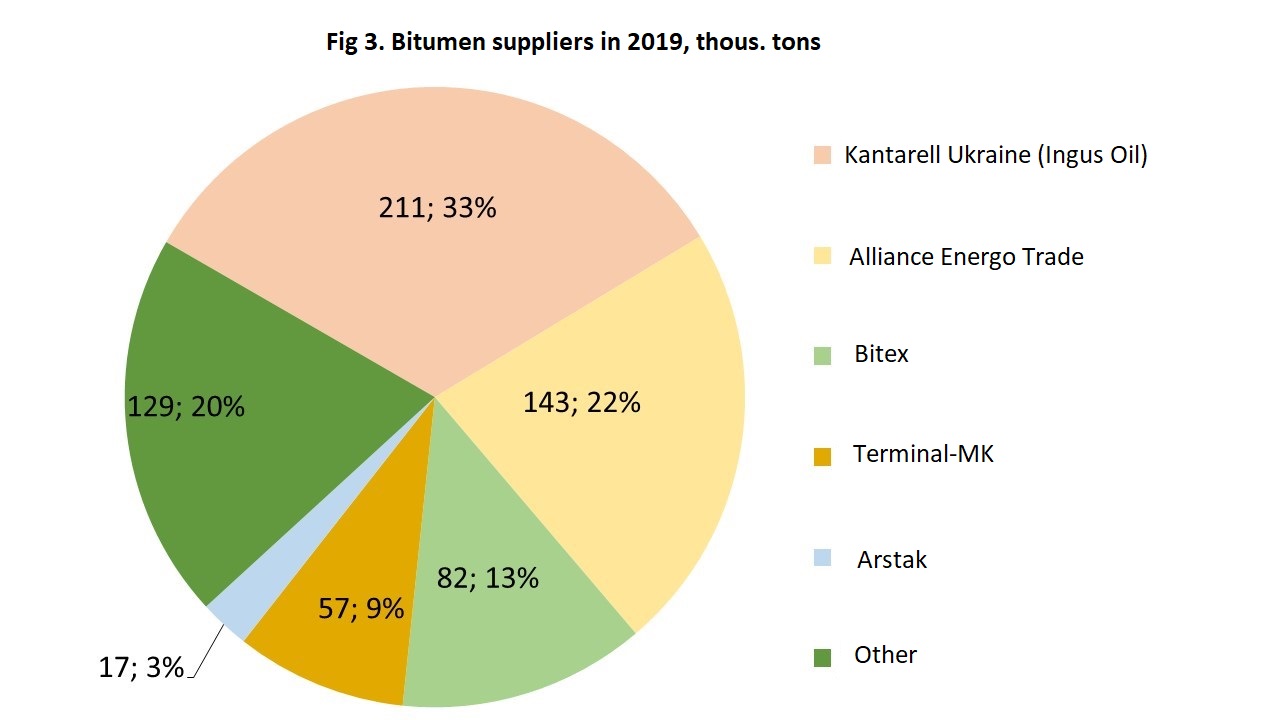

Union of four

The bitumen market has four undisputed leaders that consistently provide more than 60% of supplies. In 2019, the Odessa-based Kantarella Ukraine, previously known as Ingus Oil, opened up an edge over competitors. Demonstrating the result of 211 thousand tons (a third of the market) it became the biggest both in terms of imports and purchases in Kremenchug. Large volumes of supplies are provided through the work with well-established construction companies, such as Avtomagistral-Yug, Altcom, Onur, and dozens of smaller consumers.

The second place with a volume of 143 thousand tons is held by Alliance Energy Trade. This player has been actively developing in all directions, building new storage facilities and asphalt plants, increasing the fleet of bitumen trucks and establishing construction divisions.

The third and fourth lines, respectively, are held by Bitex and Terminal-MK.

The Top-5 list of bitumen traders of 2019 is closed by the newcomer Arstak. Unlike the above-mentioned colleagues, this is a pure wholesale trader working with all types of Kremenchug fuel without industry reference.

The specific features of bitumen handling require availability of storage infrastructure, rolling stock and long-term relationships with consumers. The first four operators have been holding strong positions over the past few years, and therefore any changes here are unlikely.

Data source: A-95 Consulting Group

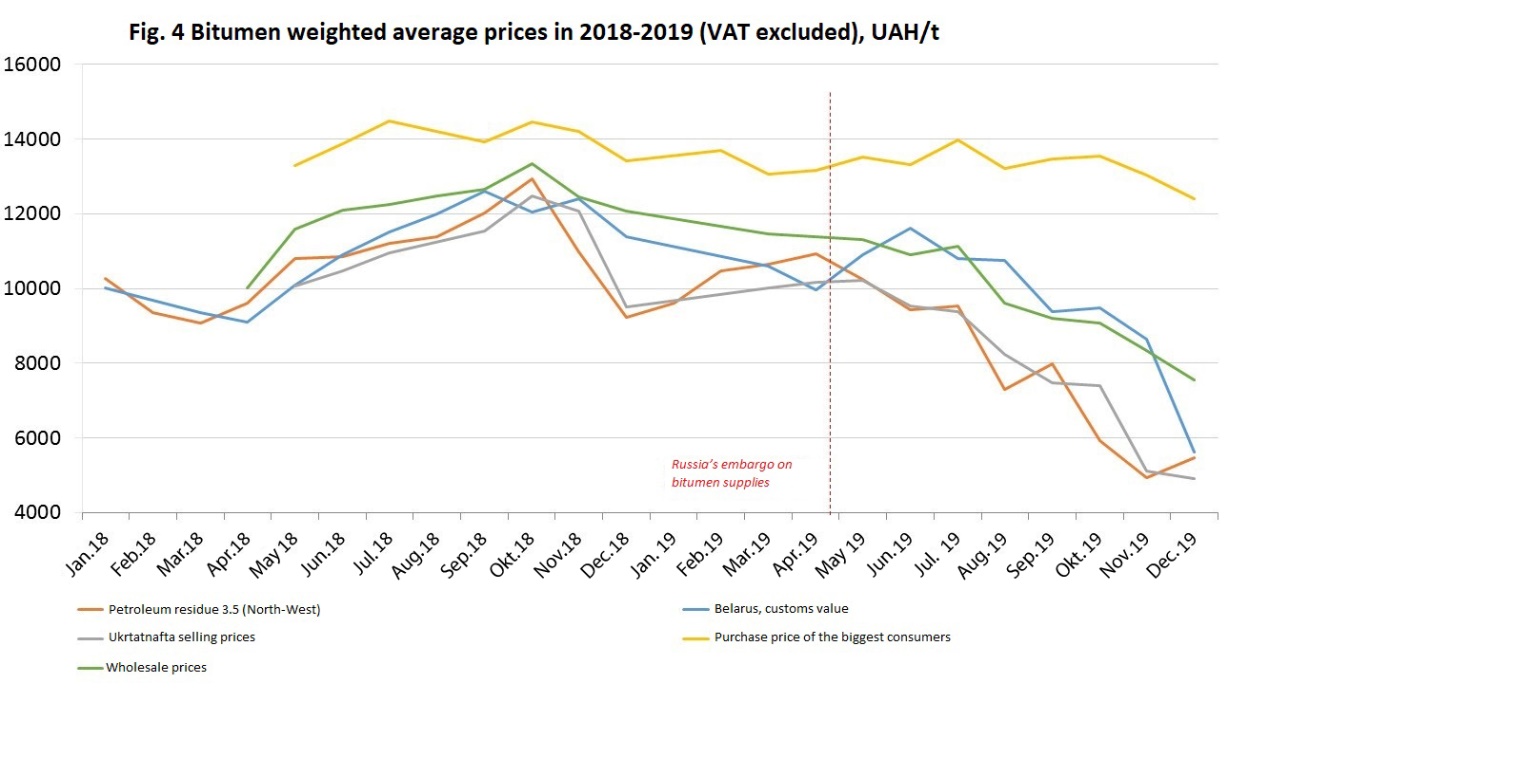

Crisis to help

In 2019, bitumen prices moved in the fairway of the global oil market, although experiencing certain deviations. In 2019, world prices for petroleum residue with 3.5% sulfur, which until recently served as reference to bitumen producers, decreased by USD 80/t. Similarly, the bitumen sale prices in Ukraine fell: if compared to 2018, they dropped from 14 500 UAH/t to 12 000 UAH/t (including VAT). In full accordance with the global developments, behaved the prices of Ukrtatnafta. Everything is quite simple here: on the eve of the 2019 season, the plant distributed its volume among the biggest traders on term contracts, linking to the specified quote of 3.5% petroleum residue with small benefits and discounts relative to this level, depending on the volumes.

Belarusians opted for a different path. In 2019, they refused from the term contracts they used to have in 2018, preferring spot sales. And they turned to be right! The Russian bitumen embargo, imposed just before the start of the season, provided Belarusians to trade at record premiums and maintain the profitability of the Ukrainian sector, despite the 10% loss of supplies. As a result, at the background of a global drop by $80/t, Belorussian bitumen fell in price by only $27/t.

Ukrtatnafta has already corrected the mistakes. According to traders, for the season of 2020, the manufacturer has kept the term contracts practice, but revised their components significantly. Thus, the plant used the quote of 1%, not 3.5% petroleum residue as a base, and added a fixed premium in the amount of USD 60/t.

"One percent petroleum residue is more expensive than sulfur one by USD 50-60/t, and given the premium of USD60/t, the margin will increase to USD 120/t compared to last year," said a market player on conditions of anonymity.

In fact, it means that in terms of the amount of premiums, Ukrtatnafta will even exceed last year's level of premiums for the Belorussian resource. Given the fact that in terms of volumes these two biggest suppliers have become very close, a similar price policy should be expected from the Belarusians. Although a number of factors indicate that the Belorussian bitumen can be even more expensive. First of all, there are no cheap alternatives to this segment and nothing will prevent from asking for another couple of dollars in premiums. Secondly, no one knows what kind of bitumen production will be this year.

"No one can tell you this now (the volume of bitumen production by Belorussian refineries in 2020 - Author's note). Neither the load volumes of the refinery, nor the quality of the oil that directly affects the production of bitumen, are known. E.g. one can't produce it using light Azerbaijan oil, " says representative of the Belorussian oil industry on conditions of anonymity.

If there is less Belorussian bitumen, one can't rule out its price growth, especially as mentioned above, the market will need increased volumes this year. If we consider only the Kremenchug product, its forecasting cost at current oil prices and the dollar exchange rate of 27 UAH will be 6700 UAH/t (including VAT), while the average selling price for the largest contractors in 2019 was almost 10,000 UAH/t.

Data source: A-95 Consulting Group

At the moment, the key issue is the possibility of implementing the Bolshaya Stroyka (Big Construction) government program for 2020, which provides for the unbelievable over 100 billion UAH. Recent events have already made it clear that many government programs will be closed, and the largest of them is unlikely to escape this fate.

Based on the materials:https://enkorr.ua/ru/publications/neispovedimye_puti_bituma/240700